An Epidemic of Long-Term Optimism

by TriLake Partnersassistant surgical mask dispenser

Amidst the very real human tragedy of a pandemic, capital markets continue to chug along.

The tech-heavy Nasdaq and Shenzhen indices are north of 9% and 8% respectively year-to-date of this writing. The more “traditional” S&P500 and major Europe-ex-UK markets are sitting on mid-single-digit gains. All major bond indices, especially the long ones, are well ahead.

So while Covid-19 is certainly grabbing attention, it is clearly not the only thing driving markets. We are in earnings season and around 80% of S&P500 companies have already given their fourth-quarter results. The majority have exceeded expectations for revenue and earnings and only 34 companies have thus far acknowledged some impact by Covid-19 or provided downward guidance for their first-quarter results. More companies—many of whom reported in the early days of the outbreak—indicated that it was too early to tell.

Some analysts have taken on a more optimistic tone with the return of Chinese workers from their extended Lunar New Year holiday. But at a briefing by Julius Baer, Dr. Wang Linfa, Director of the Programme in Emerging Infectious Diseases at Duke-NUS Medical School, cautioned that this may also exacerbate the spread in the workplace. He said the next 2-3 weeks is a critical test of how effectively contagion has been slowed by all the concerted efforts. And let’s not forget there may be millions of people who still cannot return to work for various reasons: quarantine, closure of factories and stores, the downturn in travel and tourism businesses.

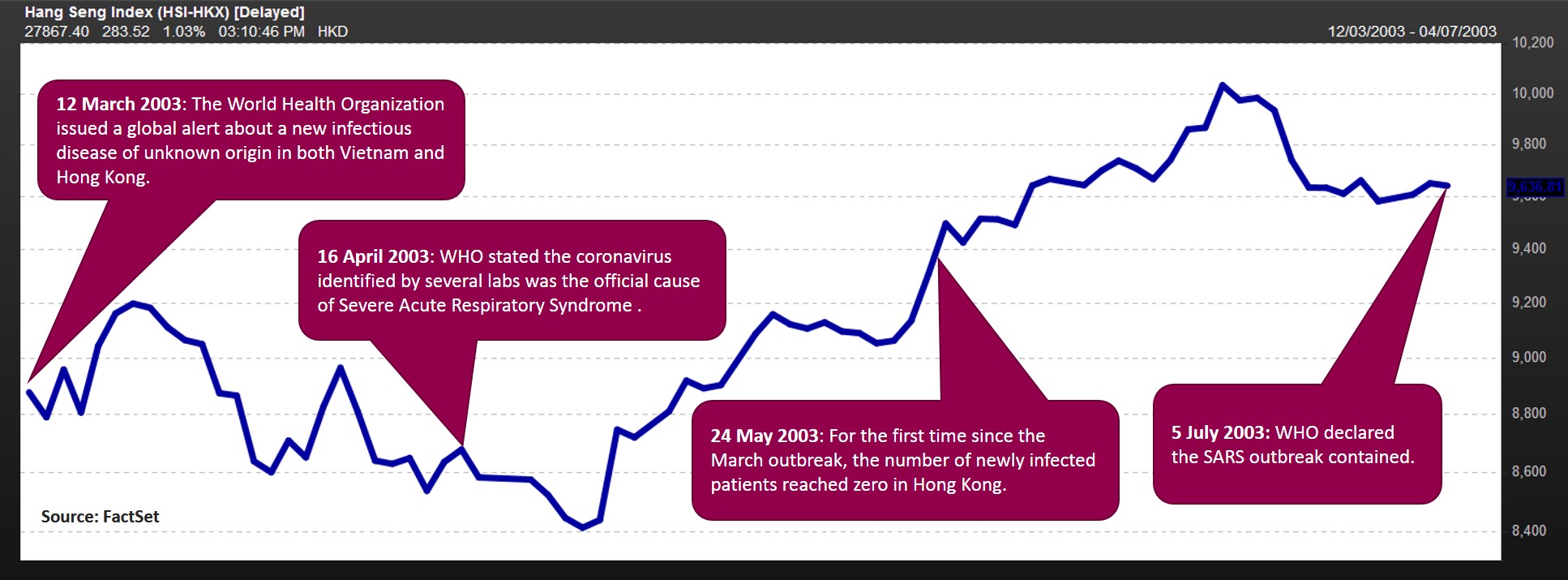

Perhaps we can take heart in the following chart of the Hang Seng Index during the SARS epidemic which hit Hong Kong particularly hard.

Most people associate SARS with Hong Kong even though it most likely originated in Guangdong. In 2003 China wasn’t the economic powerhouse that it is today but Hong Kong was already one of the world’s most important financial centres. Giants like China Telecom and Bank of China had just IPO’d months before the outbreak, preceded and followed by other now-famous companies. China Life, Great Wall Automotive, Tencent, the list goes on. And like today, we can see that markets looked forward to containment.

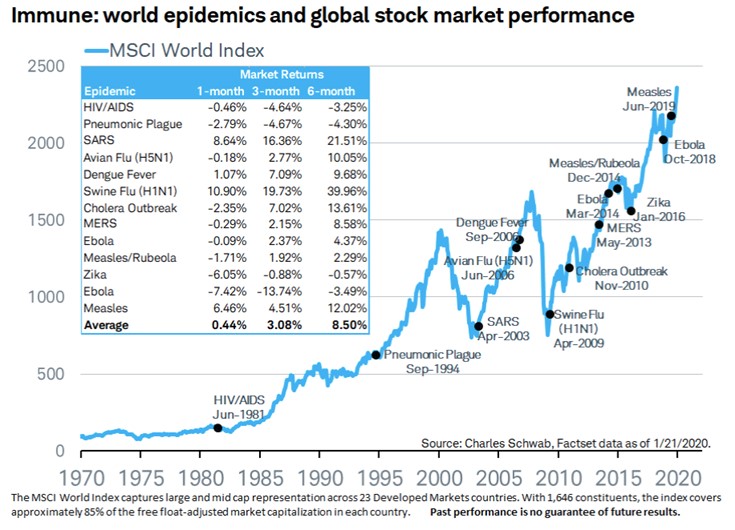

The situations aren’t parallel of course: China is much more integrated into the world economy now as the world’s top trading nation. Global supply chains are longer and wider. China and most other countries have been quicker and more forthcoming with information-sharing during the current episode. And yes, the world has learned from HIV, SARS, MERS and other epidemics since.

Capital markets are forward-looking beasts and those who ride them are most of the time optimistic about future prospects. Listed companies are the best businesses in the world, constantly striving for growth of revenue and earnings, creating value for stakeholders. Investing in these companies’ equity and debt have been rewarded accordingly over time.

Covid-19 is unlikely to stop or significantly delay the rollout of G5. It will not be a factor in the ongoing adoption of cleaner energy sources, autonomous driving, gene therapies, meat alternatives, cannabis, blockchain and better batteries. Populations from Europe to Japan will continue to get older. Some societies are getting angrier but the middle classes of the emerging markets are expanding and spending.

And surely Covid-19 won’t be the last new virus to leap to humans. Housing crises, rapid urbanisation and the destruction of natural animal habitats will result in other animal-to-human transmissions that can further mutate and wreak the same havoc we see today.