It’s a jungle out there

by TriLake Partnerskeeper of the minutes

The February monthly meeting of the Variably Interpretative Chief Investment Officers Union (Singapore) will come to order. Please note that we are celebrating the third anniversary of the founding of VICIOUS so the Board has generously sprung for pizza and beer on the back table. As soon as you get yours, let’s all settle down and be seated. Sergeant-at-Arms, do we have a quorum?

Yes, Mr. Chairman. Fifteen out of twenty total members are present.

Thank you. We’re now in session. You’ve all received a copy of the January minutes. Any matters arising from the minutes? Any corrections? Objections? Put your hand down, Frank. We are not going to reconsider your logo suggestion. Last month’s vote was overwhelmingly in favour of the gender-neutral logo. Now, first order of business: As you know we have accommodated a request from one of the local TV stations to provide members who will give colour commentary when they open and close the stock exchange every business day. We need volunteers for March. Anyone? New faces please? How about you, Mike?

I’ll be on holiday half the month.

That’s alright. You can be there for the other half. Anyone else? Noli?

I have a face made for radio.

Good point. Whatever happened to your New Year’s resolution to lose 10 kilos?

That was a Chinese New Year’s resolution.

Ever the procrastinator, Noli. Alright then, if there are no other volunteers, Mike will join our usual cadre of hams on business TV for March. Yes, Mike?

Happy to do it, of course, but I have to wonder why we do this when none of us watch the show or even want our clients to watch the show. Don’t we all discourage our clients from paying attention to the daily noise in the markets? It’s mostly noise anyway.

I think we all agree, Mike. We’re keen to foster better relationships with the media for many reasons and we all try to insert some meaningful market knowledge in our daily commentary. The stuff about daily market movements have the average shelf life of this morning’s sashimi but we try to focus more on longer-term trends and less on short-term sentiment. I know, I know: Easier said than done. They’re the professional journalists and we’re the investment professionals. We have to work with them and nudge them to reduce the financial porn and add more financial knowledge. Work in progress, am I right? Moving on to our second item of business: I’ll let Kim explain his proposal.

Thank you, Mr. Chairman. My proposal is simple: We take out a full-page obituary in the Straits Times laying 2018 to rest. I’ve done a mock-up here on screen and you see the headstone that reads, “Here lies 2018. The worst year in the history of portfolio management. 2018 is survived by his child 2019, geopolitical risk, near-zero interest rates in Japan and Europe and the music of Cardi B. In lieu of flowers, further investments at the current P/E ratios are encouraged.”

(polite applause)

Thank you, Kim. It’s succinct, witty, different. Tell us, what’s our objective here?

The obituary is meant as a light-hearted spin on a gruesome year for our clients.

Can we blame our clients for complaining? They have every right to be upset with negative returns regardless of market benchmarks. It’s their money. Our clients understand that if we never lose money, we’re probably not invested optimally if at all. I’m sure there are some of us who switched a lot to cash in the second half—congratulations—but how many of those were able to rebuild their positions at year-end? Comments from anyone? Yes, Sanjay.

I agree with you, Mr. Chairman. We’re in the business of taking calculated, compensated risks. We’re not in the business of apologizing for the capital markets. That said, even if our clients understand that, it still hurts to lose money. We take our lumps. I know the responsible members of our Union do not promise to beat the markets. We don’t promise positive returns all the time. I yield the floor to Sheila.

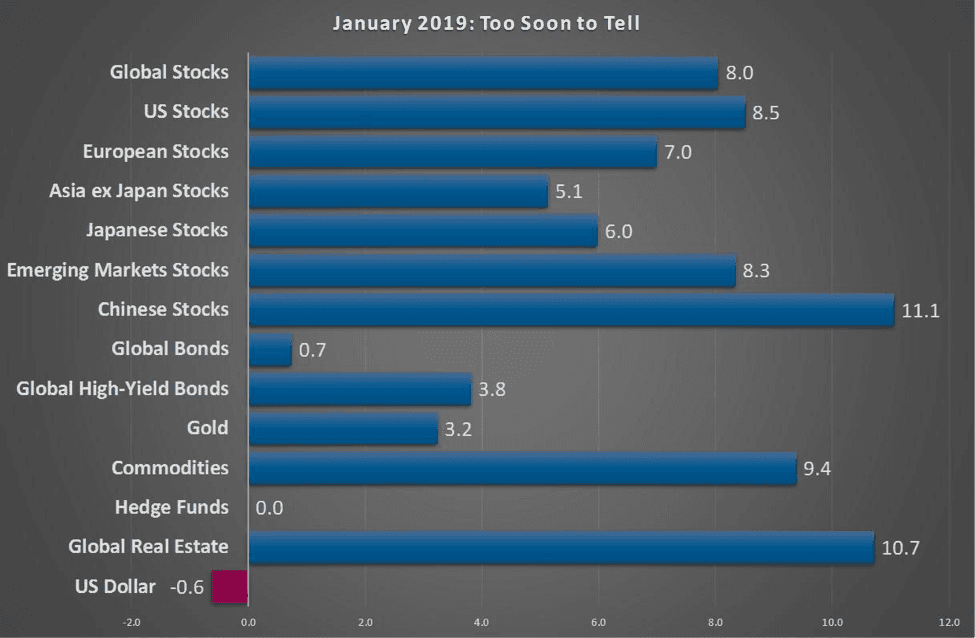

Thank you, Sanjay. Perhaps we should reinforce that message: We are invested in the capital markets because the money markets have offered negative real rates of return for the last two decades. 2018 happened to be a year when the USD money markets gave the highest return amongst the major asset classes but even then, it was barely a positive real return. I do like the idea, Kim, so I move that we publish the obituary on WeAreVicious.com and any other website of our member-firms that would like it.

It’s been moved to keep our gallows humour to ourselves and make the obituary available on our website and any other member’s websites. Any second? Any objections? Yes, Andrew?

I must object to the possible publication in other websites other than our own especially when it will be attributed to this group. I appreciate the obituary’s humour and welcome it on our website where we can clearly identify it as humorous commentary. But I for one am not convinced that the downturn that started in 2018 is over. Someone might interpret the piece as a shared opinion that the worst is over and that the markets are off to the races again. Most of us here had a very good January. But I can’t help but feel déjà vu. The near-unanimous optimism back in January 2018 immediately led to the volatility rout by the end of that month.

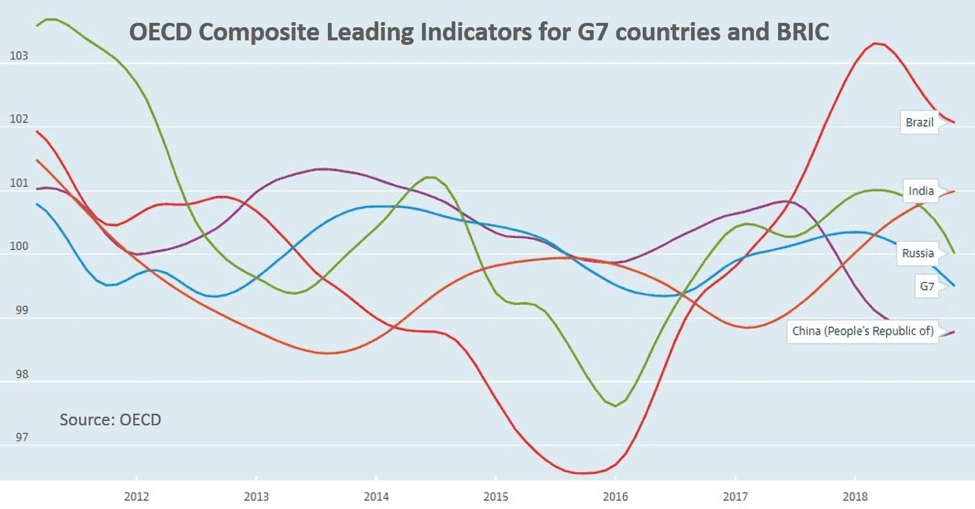

I agree with Andrew, Mr. Chairman. True, there aren’t too many serious concerns about global recession this year but let’s not forget that the OECD’s global leading indicators for most countries are still on a downward trend. I move that we publish Kim’s obituary only on our website with the appropriate disclaimers.

I second the motion, Mr. Chairman.

Good. Moved and seconded. Next on the agenda: our second Annual Forecast Dinner. Let’s hear an update from this year’s committee chairperson, Ingrid.

Thanks, Mr. Chairman. As you all know, our Annual Forecast Dinner will happen on the 28th. That’s when we reveal the firm whose predictions for various market measures came closest to the actual year-end values. Yes, a lot of our predictions for securities from last February were wildly off but there were some macroeconomic numbers that were on the money. That will be followed by the roundtable where our invited guests will witness the geeky spectacle of each one us announcing our forecasts then tearing each other down for the differences. Remember: it’s all for charity and all in good fun. Hopefully nobody loses their temper this year, right, George?

(nervous laughter)

Hey, in my defense, Johann got a little personal last year with his joke about my mother’s personal portfolio. No messing with our mothers!

Take it easy, George. We ALL thought it was funny. Please continue, Ingrid.

So keep it light, keep it clean, it’s a family show, folks. We have sent out invitations to your invited guests and we look forward to your forecasts and your feeble defenses for them. Since a lot of things can happen between now and the Dinner that can change our views, please submit your final fearless forecasts by the close of business on the 27th. We need time to prepare the slides with your forecasts and you can also prepare to be skewered on stage. Yes, George?

I suggest we emphasise at the start of the event that the main purpose is charity and healthy debate, not prognostication. We all know the follies of forecasting outcomes of super-complex systems like markets, especially in the short term. And I don’t wanna hear how your fabulous new quantum computer is run by artificial intelligence and Santa’s elves.

That’s because your mother knows Excel better than you, George.

Haha, thank you, Ingrid. That’s our agenda, folks. Any other matters you want to discuss?

Mr. Chairman, please note that Johann has submitted his resignation from the Board and from the Union as he is no longer CIO at Bank [redacted] since October.

Yes, it’s unfortunate. We will need a new Treasurer. Does anyone know why Johann resigned?

Word is, the salespeople revolted because he didn’t issue enough BUY recommendations last year.

Are you kidding me? Not enough BUY recommendations in 2018? Wasn’t he RIGHT?

Of course he was but we all know how that bank works. Their salespeople rely on the BUY recommendations when they’re smilin’ and dialin’ their customers and prospects.

Smilin’ and dialin’? More like churnin’ and burnin’. This is why we need to formally adopt the proposed Code of Conduct as soon as possible.

About that Code of Conduct, Mr. Chairman. Bank [redacted]’s new CIO says he can’t join VICIOUS if he is to be bound by it.

Goodness gracious. We will miss Johann. I hope he’s okay.

I think so. I heard he’s interviewing with SCR External Asset Managers.

Really? Wait a minute? Hey, Michael, aren’t you the CIO of SCREAM?

(awkward silence)

Oh hey look, there’s more beer and pizza. This meeting is adjourned.