It’s a jungle out there

by TriLake Partnersresident at game warden

Markets don’t come with warning sirens but sometimes if you put your ear to the ground, you can hear an ominous rumble to warn you of a distant incoming wildebeest stampede. The hard part is distinguishing that sound from all the noise in an especially cacophonous world marketplace. And that rumble you hear may just be from your banker’s tummy. Trying to discern signal from noise is at best difficult and well-nigh impossible to most. This is why we believe it is important to build a flexible investment portfolio that has a well-defined purpose beyond a targeted risk and return.

In our experience, we see portfolios that are often shaped less by the investor’s personal requirements and more by the nature of the investor’s engagement with his banker/adviser. If you’ll excuse my stretched metaphor, they either resemble hyenas or elephants.

Hyena portfolios are borne of transactional relationships and are characterised by a broadly-stated financial objectives often with no time dimension. “Mrs. Investor has an investment horizon of at least five years and is looking for returns that would exceed one that she could otherwise earn from bank deposits.” By definition, any “investment” would have an expected (though not necessarily eventual) return that exceeds the risk-free rate. And the five year period? It’s there most likely for the bank’s compliance department to allow the sale of non-guaranteed investment products to the client.

Hyenas can find success when they run with an opportunistic pack but are essentially scavengers that feed off what’s left over after the big cats have had their fill. An exciting life, really, if you like feeding on carrion. As scavengers dependent on the results of others higher up on the food chain, their food intake can be erratic. I ate today: Thank you, lions. I did not eat today: It’s those lionesses’ fault. Similar to portfolios with ill-defined personal objectives. I did well because the markets did well (but did I do as well as the market?) I didn’t do well: it’s the market’s fault.

Elephant portfolios result from more consultative relationships that produce investment policy defining SMART—specific, measurable, achievable, relevant, time-bound—goals for the portfolio. It could also circumscribe the risk parameters within which the portfolio operates. “Mr. Entrepreneur wants to create a financial portfolio to complement his real properties and business assets so that it can eventually replace his earned business income of $XXXXXX when he relieves himself of day-to-day business responsibilities when he turns 60. The ex ante volatility/conditional value-at-risk/shortfall risk measure shall be confined to XXX on a rolling 3-year basis.”

Ideally such definitions can prevent the investment manager from taking on unnecessary risk during periods of excessive exuberance and valuation. It should also be more clear-eyed during stress; after all, the income replacement objective has not changed despite the market sell-off and therefore should be in a position to take advantage of the higher risk premiums on offer. Elephants always look bored. Nothing wrong with that. George Soros said, “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Many investors simply cannot be elephants because their higher required returns require them to take greater risk and try to run with the pack, hoping that they can break away just when that pack is headed for a ravine. In markets, that requires lonely independent thinking that may not be supported by all the data being blasted by 24-hour financial programming. Liquidity, consumer confidence, employment, asset values, these good things peak just before the ravine.

Given the fluidity of markets, we find it necessary to remind our readers that any commentary or scenario-setting by us or anyone else for that matter has a very short shelf life. We try to write our newsletter so that it remains relevant—or at the very least readable—for a period longer than the average Avengers movie. We keep it light on predictions and ex post market commentary. Yesterday’s pronouncements may be invalidated by an afternoon selloff, an earnings surprise or a tweet.

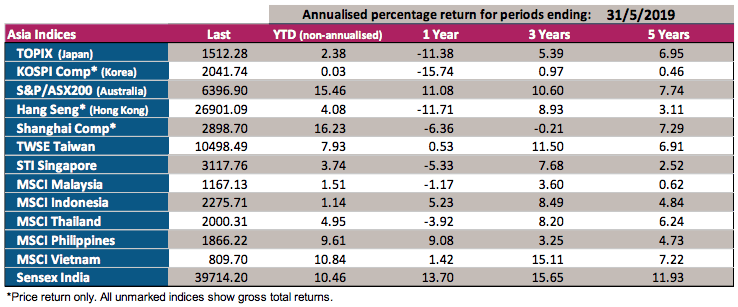

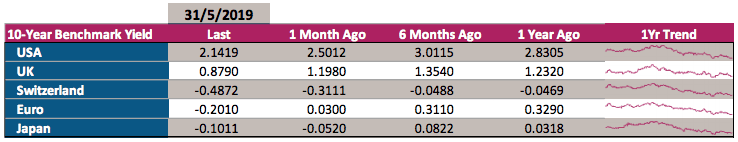

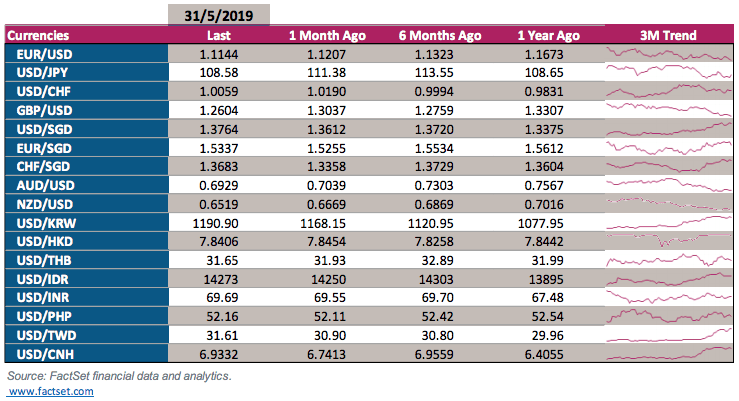

A snapshot of today’s markets outside the context of geopolitical risk suggests a rather benign world economy. Europe is still weak but growth rates of 6% and 2% for China and the US respectively can sustain demand this year. Japan’s tightening labour market has not translated to inflation but the economy is finding its footing at this end of its third Lost Decade.

But if we now bring in the geopolitical risks of trade tensions, Brexit, Iran, Venezuela and populist nationalism, the snapshot moves out of focus. According to a new Bank of America Merrill Lynch survey, a record percentage of investors say they secured downside protection against a big decline in the stock market over the next three months. Technical analysis supports this view. The first-trimester rally was fuelled by attractive year-end valuations, dovish Central Bank rhetoric and optimism on trade talk outcomes. Among those factors, only the accommodative central banks remain today. There’s a very good chance the stock market will finish 2019 in positive territory from its Christmas 2018 lows. But it’s going to be a bumpy ride with unfocused pictures taken through grimy windows.

And yet there’s a perverse beauty to be found in unfocused pictures. Disagreement and uncertainty lend themselves to a variety of interpretation. Indeed, we should always be wary of the consensus like what we witnessed in January 2018. We try to therefore be defensive at a reasonable cost. We also need to remain invested since the real-life objectives of our clients have not changed. Quick corrective action is often more productive than brave but erroneous positions.

We end with another George Soros quote from 1987: “Once we realize that imperfect understanding is the human condition, there is no shame in being wrong, only in failing to correct our mistakes.”

This document is produced by TriLake Partners Pte. Ltd. It is directed to a professional audience of prospects and clients who qualify as accredited investors as defined under the rules of the Monetary Authority of Singapore. It is not intended for distribution to, or use by, any person or entity that is a citizen or resident of, or located in any jurisdiction where such distribution, publication, availability or use would be unauthorised or otherwise contrary to applicable law or regulations. Any services referred herein are not available to retail clients. The content of this document is provided for informational purposes only and are not to be used or considered as an offer or solicitation to buy, sell or subscribe any securities or other financial instruments. Accordingly, TriLake Partners Pte. Ltd. accepts no liability for any loss arising from the use of this document. This material may not be published or reproduced, in all or in part, without the prior written express consent of TriLake Partners Pte. Ltd.