TAKE A DEEP BREATH. TAKE A STEP BACK. TAKE THE LONG VIEW.

letter from the CIO

It’s not easy to find an extended discussion of global investments that does not mention the new US president as a source of uncertainty. And for very good reason. Upending the post-World War II global order can surely upset people.

We can watch our screens until 3AM and worry about the next tweet, executive order, “alternative fact” and retaliatory act. We could try to predict the winners and losers of tax reform or protectionism.

We can also choose to take the long view.

Sixty-five years of commercial, technological and social progress that has lifted millions of people out of poverty, increased real incomes and life expectancies around the world did not happen in a straight upwardly-sloping line. The world certainly had a few hiccups in between the Marshall Plan, decolonisation, women joining the work force, China joining the WTO, the Internet, noncash transactions. We witnessed autocracies and kleptocracies, hyperinflation and Japanese deflation, Great Leaders and Great Recessions, Ponzi schemes and terrorism. We’ve played chicken with nukes and played dot-coms with real money. Yes, fearsome walls have fallen but someone still wants to build one every once in a while.

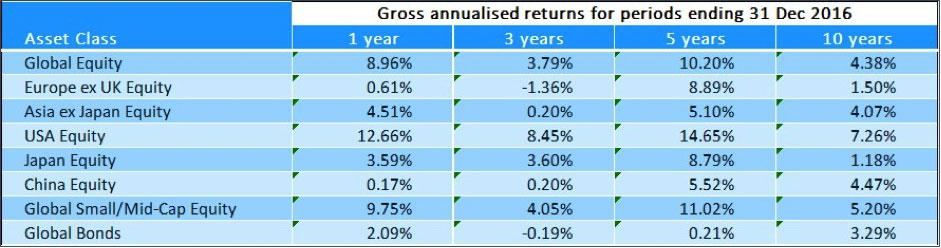

Investing based on long-term views on asset classes should prove to be safer than buying and selling securities based on short-term expectations. After all, one needs only three things to invest: capital, a market economy and enough time. Capitalism rewards those who put their capital at risk. Exposure of capital to market risk or beta—however maligned it can be from time to time—is compensated risk if you give it enough time. After all those hiccups, the market inexorably rises. Nine out of ten times, we can look back and say, “I wish I invested more money in [name your investment] five years ago.”

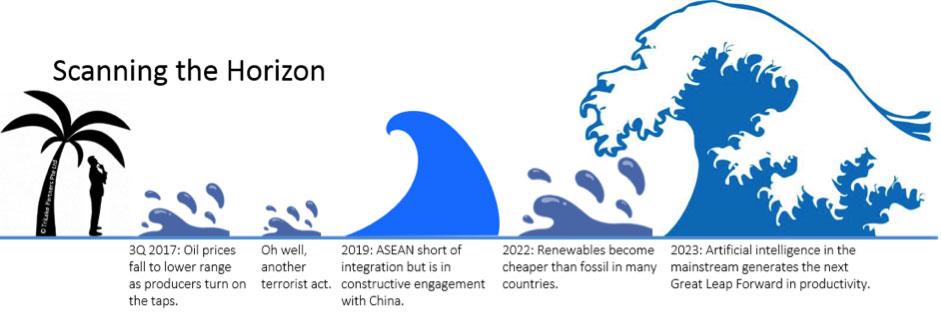

So here are some of our market views illustrated as waves hitting our investor vacationing on the beach. Waves come in all sizes and in various frequencies. You can ride some big waves, mindful that they can also be destructive. Some big waves you see in the distance die out before they make it to shore. Then in a rare moment a big wave crashes in and changes the entire landscape. Let’s find the winners. Five years from now, we know what we’ll say.

We end with a story from the late financier Bernard Baruch: A man sentenced to death obtained a reprieve by assuring the king he would teach his majesty’s horse to fly within the year—on the condition that if he didn’t succeed, he would be put to death at the end of the year. “Within a year,” the man explained later, “the king may die or I may die or the horse may die. Furthermore, in a year, who knows? Maybe the horse will learn to fly.” My philosophy is like that man’s. I take the long-range view.