Where There’s Smoken on the eve of the Year

This article is ostensibly about what happened in 2023 and what we could reasonably expect to happen in 2024. However, 2023 is better understood partly as a consequence of the prior year—our annus horribilis

The dominant storyline of 2023 started in March 2022 when the Federal Open Market Committee initiated a series of eight hikes of the policy Fed funds rate. Never had the policy rates risen so high so fast and the market pundits agreed that the FOMC had sat on their hands too long. Policymakers reasoned that inflation was largely caused by serious supply-side disruptions: The pandemic and geopolitics created dislocations in labour markets and global supply chains which should eventually be corrected by market forces. Transitory, right?

By New Year’s Eve 2022, “transitory” had become a punchline. Inflation turned out to be as transitory as Putin’s lightning-quick blitzkrieg into Ukraine or Pete Davidson’s affair with [insert any name here]. Yield curves inverted and shifted upwards, driving the final nail in the 30-year-old bond market rally’s coffin. Nominal and many real rates turned positive and investors rediscovered value as a lens in investment decision-making.

Assets had already re-rated tremendously going into 2023 but heretofore this was largely a reduction of PE ratios as investors recoiled from paying nosebleed multiples. The valuation retreat presaged an earnings recession. Also the benchmark 10-year US Treasury yield moved from 1.5% to 3.9% over 2022. Since practically every financial asset in the world’s capital markets is valued against the 10-year US Treasury bond, only the money markets provided refuge. More than a trillion dollars poured into money market funds as investments in stocks and bonds became increasingly hard to justify in the face of risk-free Treasury bills paying 5+%. Prudence suggested to just stick to cash or the most solid stocks with fortress balance sheets.

And the Fed was nowhere near done as 2023 came. Expectations were subdued for US assets. As rates steadily rose and the yield curve inverted, we wondered where the bellwether 10-year rate would be by year-end. [Spoiler alert: right back where we started at 3.9%]

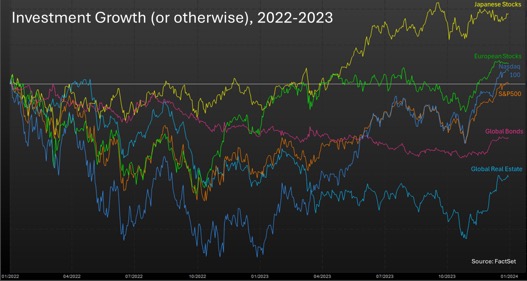

China was licking mostly self-inflicted wounds and looked to sit out the game for another year. Europe proved that, as cheap as it was compared to the US, it could get even cheaper. But there were bright spots, the hum about ChatGPT (generative AI) and GLP1 (anti-obesity drugs) grew to a roar. As for those solid stocks with fortress balance sheets, the markets turned to the Magnificent Seven after they had trimmed excess pandemic hiring and tech became the new defensive. Corporate and market reforms started taking hold in Japan and the Sage of Omaha increased his stakes in the country’s five giant trading houses to some 8.5%. Unlike the bad breadth that characterised the US equity rally in 2023 where the Magnificent Seven ran rampant and left the 493 other index stocks mopping the trading floor, the rally in Tokyo was more equitably experienced by large-cap Japanese stocks.

Emerging markets as usual had widely disparate results but their central banks were lauded for having taken the fight to inflation much earlier than the Fed, the Bank of England, the Bank of Japan and the European Central Bank. Consequently, the rise and eventual fall of interest rates in the emerging markets wasn’t as steep as those in the G4. Yes, around a quarter emerging and frontier markets fell into distress. But the world was already underinvested in EM/FM debt as we watched the horror show unfolding in Chinese real estate, the industry that once dominated bond issuance in the developing world.

2023 ended with many financial asset classes recovering from the historic losses of 2022. The US equity market rode the Mag 7 and a tight labour market back from its 2022 lows. Bond prices steadied as the G4 central banks called a pause (a halt?) in the rate-hiking cycle and rallied in the last two months of the year. Real assets like commodities and real estate struggled. The troubles of commercial office property and regional malls continue in the US. Supply discipline and a new war in the Middle East somehow did not result in oil prices rising over $100 per barrel as global demand receded.

Which brings us now to (Chinese Lunar) New Year’s Eve 2024. The G4 central banks are more likely to cut rates than hike. Global inflation has come down significantly but it’s not hard to find the warning signs that the war against inflation is not over yet. Nevertheless, the base case scenario now appears to be a very soft and short landing where the economy contracts by half-to-one percent. And right on time, the US yield curve has started un-inverting itself, something that has presaged practically every recession in the last fifty or so years. Big deal, investors sniff, it’s the most widely anticipated recession in history and let’s just look beyond it.

Good advice: look beyond the next 12 months. The industry is in the habit of making projections and predictions for the coming year. Why? Most investors have investment horizons that extend far beyond one year and it’s always wise to keep that long-term perspective. Capital markets and their stocks and bonds have always compensated long-term investors whilst often punishing those who dare trade and churn in the short term. Systematic risk—the risks that cannot be adequately diversified away—has returned to the fore as positive interest rates have returned (even in Japan!).

Long-term investors can be assured that intelligent risk-taking can still be compensated with appropriate returns but it won’t be a smooth ride. Human emotion will inevitably lead investors to oversell and overbuy in the near term so let’s look at some of these potential areas of excessive fear and greed and see if we can discern if the smoke is from a dying fire or otherwise.

US stocks. Never have the seven largest stocks account for more than 30% of the index’s market capitalisation. This did not develop over the last ten months as Nvidia and company broke away. Indeed, every sector in the US is now dominated by a handful of companies. US stocks look expensive compared to other markets and to its own history. Will the rest of the S&P 493 and the Wilshire 4093 catch up or will the Magnificent 7 fall back in line with the rest? Will the Mag 7 find more room to run? After all, at least one of them—Nvidia—still trades at a reasonable PEG ratio. A more morbid thought: Will some of the Mag 7 fall like they did in the movie of the same name? Look to possible regulations to curb anti-competitive for that. If 2024 is truly the second year of a new bull market that started in November 2022, it is quite an unusual start. After all, most early stages of a bull market are led by small-cap stocks and financials. That is not happening. Yet. On the other hand, most late stages of a bull market are marked by a steep rally driven by only a few big names. That would certainly support the notion that we are in the late stage of the bull market that started in March 2009. In this light, the gyration of 2020-2022 could be ignored as an exogenous shock not caused by regular market cycles. Either way, active management may outperform the index this year. Sectoral rotation and stock picking may very well be rewarded.

US bonds. The longer interest rates stay elevated, the greater the cracks appear. Companies that finance operations by issuing high-yield bonds and obtaining leveraged loans will be challenged to refinance a mountain of maturing debt in 2024. Spreads look on the tight side and credit risk doesn’t seem to be adequately rewarded at these levels. Duration risk could pay off if interest rates do start coming back down. And even if rates stay up, investors can continue confidently clipping coupons (too much alliteration, I know) of high-grade bonds.

Developed market stocks. Europe has taught us that cheap can get cheaper. The gap between US and European valuations has never been this wide. What could reverse this decade-long trend? An end to the Ukraine-Russia war could provide such a boost but nobody is saying that such a denouement is afoot. Most of the world would welcome revived trading volumes with China. Japan’s virtuous story doesn’t seem over. The government is now incentivising more local investment in equities. Positive wage negotiations in April could assure markets that inflation is—finally—here to stay in Japan after decades of debilitating deflation (stop the alliteration now!). Look to small-caps to catch up as local consumption accelerates.

Emerging markets. A softer dollar has usually been a tailwind for EM assets and a falling yield curve could help in that regard. So would the much-awaited recovery in China. Asean could get their tiger mojo back this year. India is the best long-term story in the world but it’s hard to find bargains there. China is flashing a big “SALE! EVERYTHING MUST GO!” sign but buyers are still thinking “damaged goods” despite the bargain values of 11x earnings and 1x book. The government has recently signalled more support for its equity markets but investors could stay justifiably fearful. Policymakers will likely continue to encourage investment in clean energy so that may be a comparatively safer investment in China. As for bonds, the premium demanded by investors in hard-currency bonds remains relatively benign in light of the troubles of some distressed issuers. Funds flowed out of both hard currency and local currency EM bond funds in 2023 and this could continue this year. Diligence and a lot of patience could pay off but keep the value-at-risk in check.

Real estate. The aforementioned problems in commercial real estate, particularly office and regional retail, are still dangerous but most real estate sectors aren’t doing too badly. Housing prices and rents in the US have come off but the demand is still there. Industrial, data centres and logistics properties around the world expect a good year.

Gold. While it produces no income and may have carrying costs, every dog and goldbug has his day. Renewed inflationary expectations could support the current gold price. So could a rapid fall in cash rates as money parked in money market funds head for the exits. Cryptocurrencies are taking a bite out of gold’s traditional role too. Conservative investors like to keep 2-5% in gold at all times. Hard to justify at these risk-free rates unless you believe the US dollar and other fiat currencies will devalue.

It may be a corny way to end this article but it’s true: So long as market economies function, capital markets will still reward investors the most. And the best way to safeguard that reward is designing a well-diversified portfolio and maintaining one’s resolve through market cycles. More so now that negative and zero interest rates are becoming more the exception than the rule. That smoke you see on the horizon could be an approaching wildfire or a steamship leaving port without you. Don’t worry too much: it’s more likely to be just an ordinary investor burning last year’s market predictions.