Your Holiday Gift-Giving Guide for the Investors in Your Life

by TriLake Partnersresident reindeer wrangler

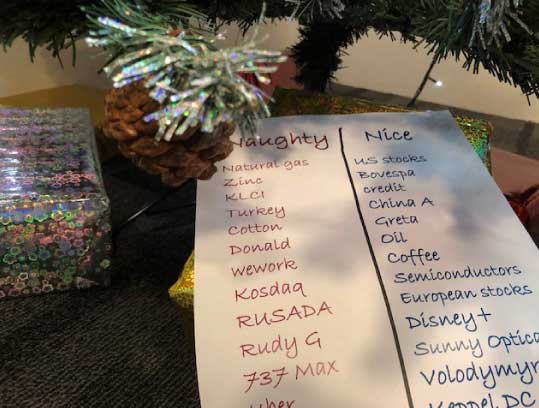

At our recent office Christmas party, I received a plush unicorn from my Secret Santa. For some strange reason that I will not get into, the office has a thing about unicorns and it has nothing to do with young companies valued at eye-watering pre-IPO valuations. Maybe we are fascinated by this and other mythical creatures like the merlion, the dragon, the rational investor and the entertaining investment disclaimer.

Anyway, I realise that I completely forgot to publish my Christmas wish list well in advance of the party. As a consequence, I am now required to house my phone in the unicorn instead of its usual resting place between my keyboard and that merlion figurine I got from my Secret Santa last year. So, dear reader, if you have read this far, I invite you to peruse my list and consider it a guide for next year’s gift for the investment manager nearest to your heart.

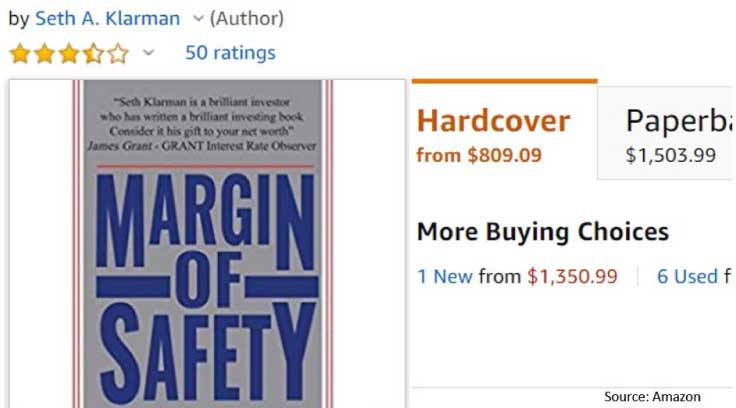

GIFT IDEA №1: A copy of Seth Klarman’s 1991 book Margin of Safety

Copies of this rare out-of-print book sell for more than a thousand dollars on Amazon. Seth Klarman of The Baupost Group reportedly refuses to update or reprint his book because he regrets divulging his value investing secrets. The book should serve as a reminder of Ben Graham’s advice to always invest with a margin of safety. One measure would be the distance between a security’s fair value and its current price. FactSet compiles analysts’ target prices for all stocks in the S&P500 to produce a 12-month target level for the entire index. This time last year, FactSet’s bottom-up target price for the S&P 500 was 3128 over the following 12-month period. This would’ve been an appreciation in price of 27% above the 20 Dec 2018 closing price of 2467. The index blew past that target price last 6 December. If we include dividends, the total 12-month return was 28%.

That represented a nice margin of safety. It stands in stark contrast to 13 December 2019 when FactSet reported, “The bottom-up target price for the S&P 500 is 3407.46, which is 7.5% above the closing price of 3168.57.” I’ve seen wider margins in Sylvia Plath’s notebooks.

GIFT IDEA №2: Prayers for Hong Kong

Singapore may be a beneficiary of the turmoil in the Special Administrative Region of Hong Kong but it’s not something anyone in the Lion City is cheering for. There are legitimate concerns and grievances and the violent episodes shown in the media are alarming but we all the financial world is a much better place with a well-run Hong Kong. Now it is the divergence of Hong Kong and China that intrigues me. There are over 50 companies that have issued so-called “A shares” in China and “H shares” in Hong Kong. Every so often, the fortunes of the A and H shares diverge, even those of the exact same issuing company. Sinopec for instance has seen its A shares rise 5% this year and its H shares fall -11%. There are of course obvious reasons for this but one would reasonably expect a convergence in the future.

GIFT IDEA №3: A trip to India

For research purposes, mind you! India recently surpassed China in terms of consumption of digital content, using 9.8GB of data per smartphone per month by the end of 2018. At the same time, the population has kept a larger share of government benefits from a streamlined process and have gained greater access to financial services. The benefits of demonitisation have taken hold. India’s corporate income tax cuts may have a longer-lasting effect than those enacted in the US last year. We’ve been out of Indian capital markets for quite a while now but the Indian consumption story from here on out is compelling.

GIFT IDEA №4: The grace to withdraw from the hunt for yield

For research purposes, mind you! India recently surpassed China in terms of consumption of digital content, using 9.8GB of data per smartphone per month by the end of 2018. At the same time, the population has kept a larger share of government benefits from a streamlined process and have gained greater access to financial services. The benefits of demonitisation have taken hold. India’s corporate income tax cuts may have a longer-lasting effect than those enacted in the US last year. We’ve been out of Indian capital markets for quite a while now but the Indian consumption story from here on out is compelling.

GIFT IDEA №5: An apartment in Tokyo

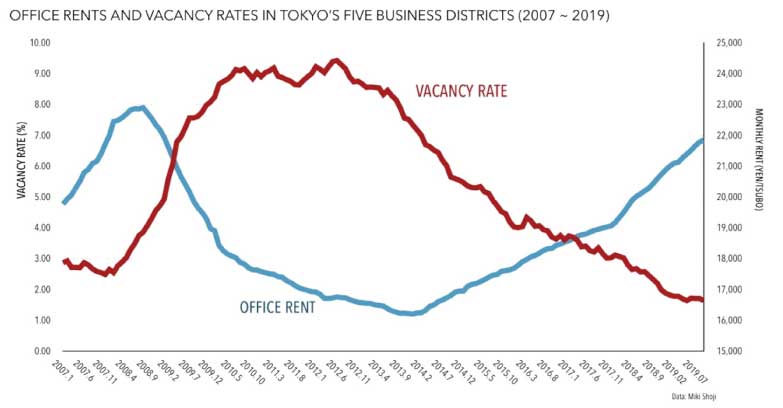

Haha I can dream, can’t I? Despite a choppy fourth quarter, the S&P Japan REIT Index has jumped 23% this year. Sure, some of that may have been fueled by the upcoming 2020 Olympics in July. But office vacancy rates are reaching levels not seen in 30 years. Real estate should continue to produce a positive yield in Japanese Yen which not so long ago was thought to be another mythical creature.

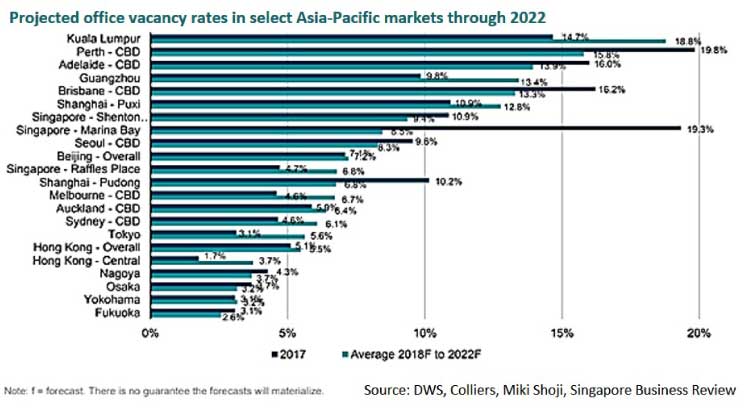

The Association of “No Vacancy” Sign Designers (you’re right; it’s fake) are reporting lower revenues elsewhere in Asia Pacific. Vacancy rates in Japan’s five business districts of Tokyo, Nagoya, Osaka, Yokohama and Fukuoka now resemble the percentage of its population under five years of age.

GIFT IDEA №6: Keeping At It by Paul Volcker and Christine Harper

High inflation triggered by the 1973 oil crisis and the 1979 energy crisis carried over into the 80s. Folks look back at the Reagan years with fondness and a bit of a rose tint in their nostalgia glasses but I would give most of the credit for the Great Economic March Forward from the malaise of the 70s to Carter appointee Paul Volcker. The Volcker-led Fed administered the bitter medicine of higher interest rates and (finally?) suppressed inflation and started the decades-long bond rally. Around the world, the focus of central bankers turned to inflation-fighting and the world has never been the same. Heck, capital markets have never been the same. Forty years later, we are now seeing the cracks in the monetary wall and it takes the intellectual honesty and humility exhibited by the late Fed Chairman to rethink and confront these new problems. Why, for example, are policymakers so skittish about wage growth as a harbinger of future inflation but care not a bit about ever-growing corporate profits? RIP, Mr. Volcker.

GIFT IDEA №7: And yet another book. Jonathan Tepper’s The Myth of Capitalism.

High inflation triggered by the 1973 oil crisis and the 1979 energy crisis carried over into the 80s. Folks look back at the Reagan years with fondness and a bit of a rose tint in their nostalgia glasses but I would give most of the credit for the Great Economic March Forward from the malaise of the 70s to Carter appointee Paul Volcker. The Volcker-led Fed administered the bitter medicine of higher interest rates and (finally?) suppressed inflation and started the decades-long bond rally. Around the world, the focus of central bankers turned to inflation-fighting and the world has never been the same. Heck, capital markets have never been the same. Forty years later, we are now seeing the cracks in the monetary wall and it takes the intellectual honesty and humility exhibited by the late Fed Chairman to rethink and confront these new problems. Why, for example, are policymakers so skittish about wage growth as a harbinger of future inflation but care not a bit about ever-growing corporate profits? RIP, Mr. Volcker.

GIFT IDEA №8: The new Nintendo Switch

I could use a little escapist fun to lift my spirits after reading Tepper’s book.

GIFT IDEA №9: The new album by The Beths

Fine, it’s not out yet. So treat yourself to their first full album Future Me Hates Me. You’re welcome.

We don’t often write about specific investment ideas because of their short shelf life so the usual investment disclaimers apply. Mainly: Something could happen in the next couple of days or weeks which changes our minds completely about credit spreads or Kansai real estate. I won’t be able to email everyone to recall this newsletter and say I was wrong because, well, I’ll be on the beach in Siargao and you’ll likely be skiing somewhere in the Alps.

May we all be blessed with 20/20 market vision in 2020 and may you have yourself a merry little Christmas.